Classic cars are a beauty – a true symbol of a more elegant era that’s never to return.

Despite their historical status, many people still can’t quite understand how classic cars can be good investments. After all, a vehicle is a physical asset that depreciates by a quarter of its value per year. Also, the advancement in automotive technology today renders these cars impractical to use or even maintain.

Is It Wise To Invest In A Classic Car?

The answer is still “Yes!”, and here are the reasons why.

Historical Evidence

A classic car is one of the best-performing assets in the last two decades. It’s no longer just a fancy collectible for display in a random millionaire’s garage. Instead, it has become part of the long-term strategies of many investors around the word and many pieces of evidence exist to prove this.

One example is the Ferrari 250 GTO owned once by Sir Stirling Moss. In 2002, it was sold for $8.5 million. After 10 years, it was sold for $35 million, which is more than four times the previous value. Two years later, another 250 GTO was sold for a record of $38 million. And in 2016, Simon Kidston (K500 founder) sold a Ferrari 250 GTO for an undisclosed amount. It is rumoured to be more than $60 million.

Another classic car that sold well is the Ferrari F50. One of which with 10,000-kilometre mileage was sold by RM Auctions for $783,044 in 2013. By 2017, another Ferrari F50 (2,000 km mileage) was sold by the same company for $3.18 million. The classic car market has been historically liquid, with low spreads and volatility. Any change in supply and demand has a very small effect on the prices.

The Classic Cars Market

Classic Cars are good investments because its market is currently experiencing high activity. Inflation has greatly affected all cash investments, so investors are diverting to alternative assets like wine, art, and classic cars to protect their assets. The demand for high-yielding investments is sky-rocketing and alternative assets such as classic cars are the best bet of many investors.

The Trend Says So

Investing these days is simply not the same as before. The trend is going towards more profitable alternative assets, just like classic cars. According to an article by Financial Times last year, the worldwide shift of investments to alternative assets has been gathering pace. Many investors are already including alternatives to their investment portfolios due to the disappointing returns from mainstream asset classes.

The same article says that in 2016, the overall assets handled by the top 100 alternative investment managers have risen to more than $4 trillion. This is 10% higher than the overall asset value in 2015. Blackstone, the largest alternative assets manager in the world, has alone experienced an 8.3% increase in alternative assets in 2016. That increase amounted to $302 billion.

Economic Cycles

The classic car market works just like any other capital market, which means its activities, run in economic cycles of 4-6 years. An economic cycle is the natural rising and falling of an economy between the periods of growth and recession. The last cycle for classic cars started in 2010 and reached its peak in 2015.

The market has been relatively soft again last year, which means 2017 is the start of another cycle. You can trust that the market will again peak in three to four years. That’s why classic cars are good investments right now because you can also expect a good return in the succeeding years.

Which Classic Cars are good investments in 2018?

Classic cars from the 80s and 90s are really thriving at the moment. When looking for a classic to invest with, always go for rare finds. The rule of thumb is the lower the production number, the better investment potential. That’s why the Ferrari 250 GTO is such a hit — only 39 units of this classic is out there somewhere.

Here are other classic cars worth your investment in 2018:

Honda Integra Type R

Known as the best front-wheel-drive car of all time, the Honda Integra Type R was first sold in 1995. It also has the finest handling among FWDs and considered a modern classic. This sports coupe was praised by many critics around the world. A recent auction sold an original 1995 Integra Type R for $90,000. You can start investing with 2000 models, which are currently priced at $13,000.

Renault Sport Megane R26

This is one of the most desired classic hot hatches today. First produced in 2006, the R26 model of Renault Sport Megane has already considered a collectible due to its story. It was built to commemorate the success of Renault in the 2005 Formula-1 World Championship. Right now, it’s selling at $14,000.

Lexus IS200

This sedan is the European equivalent model of the award-winning Lexus IS in 1998. It rivalled the BMW 3 series sedans not just in performance, but also in style and aesthetics. 1999 models are currently selling in Australia at less than $5,000.

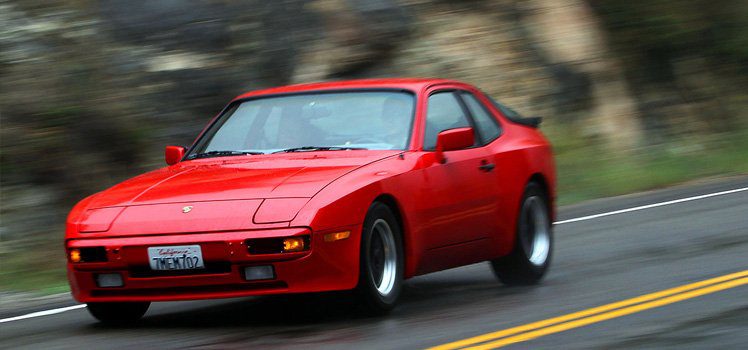

Porsche 944

The 944 is a 1980s classic sports car from Porsche. Available in both manual and automatic transmission, the former is already selling from $30,000 to as high $90,000. Porsche 944 Automatic is priced below $20,000, but the manual transmission variant will most likely sell for a higher price in the future. This front-engine, rear-wheel drive model is the best-selling sports car in the history of Porsche.

BMW 3 E46

Another 90s classic, the BMW 3 Series E46 is produced in sedan, coupe, convertible, wagon, and hatchback trims. It is the first among 3 Series cars to have an engine with variable valve lift engine. 2002 and 2003 automatic are currently selling in Australia starting at $24,000, while manual variants sell at $41,000.

Invest in Classic Cars through Finance Ezi

Just like any other investment, bear in mind that classic cars also have attributed risks that you have to take. These include the risks of damage, theft, and fire. You can lessen the chances of losing your asset by having the car insured. Aside from this, you will need to store it properly and maintain the mechanical parts. You can also hire experts to take care of it.

Nevertheless, classic cars are clearly worth your investment. Buying a 90s classic car today is likely to yield a high selling price for you in the future. If you want to start investing in classic cars now, there’s no better place to get your classic car finance but Finance Ezi.

Call us on 1300 003 003 or apply online and chat with our finance professionals to get a conditional approval for your classic car.