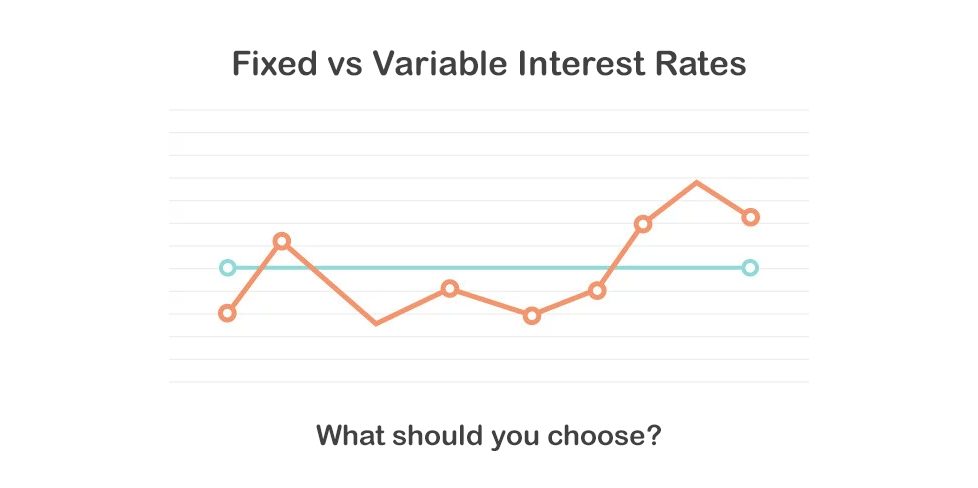

Big, life-changing purchases such as a house or a car usually require a loan (unless you are absolutely loaded). It is going to cost a large amount of money so a lot of careful planning and shopping around should go into it to score the best deals. So, Fixed or Variable Rates are better for you?

One of the most important things to look at is the number of years it takes to finish paying off the loan. This is why it is essential for borrowers like yourself to know the pros and cons of fixed and variable interest rates.

Below is some important information to help you choose the right loan for you.

Understanding a Fixed Rate Loan

As the name implies, the interest rate in this type of loan will not change for a certain period which is around 1-5 years. Many borrowers appreciate this scheme because they could save for future expenses knowing how much they need to pay and when. Not only that, their payments are not affected by the rise of interest rates. However, that goes both ways because a drop in the rate wouldn’t mean the monthly repayment would be smaller.

Another important thing to note is that redraws are not possible with a fixed rate loan. In addition, if you finish paying the loan earlier than the term, then you’ll have to take care of some fees. Banks have different names for it, but the principle is the same. However, there is an initiative by the government to waive exit fees or at least, lessen them. To know more about it, you have to carefully study the terms of the loan when you talk to a lender.

What is a Variable Interest Rate Loan?

This is considered more flexible compared to the fixed rate loan and here’s why. You are allowed to make extra repayments and there will be no penalties for that. And when you put more money in, chances are, you pay off your loan faster. Multiple redraws are also possible and you can do this as many times as you want. To those who tend to look for lenders offering better terms, switching to this kind of loan wouldn’t be difficult as well.

But you have to remember, the interest rate you pay for your loan can vary a lot during its term. As interest rates go up, you’d have to pay more. But it goes without saying you will also pay less if there is a drop in the interest rate. To handle this change in the interest, some borrowers get an offset account which helps them get a lower interest in their loan.

Which one is better?

The answer to this has a lot to do with your preferences and circumstances. If you prefer certainty about the payment amount, then fixed rate loans are for you. However, the interest is only locked for the term you choose. Once that is over, then it will be at a variable rate unless you choose to fix it again.

However, here’s something to consider; if you think you’re going move to a different house sometime soon, then a variable interest rate loan may be a better option for you. You won’t have to worry about exit fees if you choose to go with this type of loan, and it will save you a lot of time and avoid the hassle of having to set aside money for it. And if you ever need cash for an emergency, getting a redraw would be easy.

Although both have advantages and limitations, there are always a few things you could do to get the most out of both. One is that you start with a variable interest rate and as you get closer to paying all of it off, you can choose to fix the rate. That way, you can plan how much you will be paying until you’ve finished it. Also, there’s a big chance that you will not be changing your plans in the immediate future. As a result, you can prepare your payments in advance and not have to be afraid of the interest going up.

Make a smart decision

Now that you know the things to consider, all you have to do is start with your search for a lender. Don’t forget to ask what you want to know when you get a quote. You’re the customer after all, and this is your future home that’s at stake so, don’t be shy. Never underestimate the value of negotiation. Talk about the great offers you have seen and ask if they are available to you. If not, they could try to compromise and you can meet you halfway.

Need Finance?

If you are needing a loan, speak to one of our finance brokers who can find you the best options. Call Finance EZI now on 1300 003 003 or apply online.