..If you’re in the market for a new car and want a clear understanding of your finance options, catch our video. We look at the benefits and disadvantages of Chattel Mortgages, Hire Purchase, and Car Lease options.

Are you in need of a new car? But not in need of the finance people talking about a million products that seem the same but are slightly different and way too confusing?

You might need to understand different financing options, here you go:

What is Chattel Mortgages?

A Chattel Mortgage is a structured loan. You basically own the vehicle immediately. However, you can claim GST, interest and depreciation components in some scenarios.

What is Hire Purchase?

Hire Purchase is an agreement of buying a new or used vehicle on credit. Buyers have to pay some initial payment. The Principle and Interest is paid off in instalments. In this loan, buyers own the vehicle at the end of the loan period or final payment.

What is Lease Finance?

Lease finance is applicable where buyers pay for fair use of vehicle. Buyer cannot own the vehicle during the term of the lease. However, they may have the option to purchase at the end of the term.

So, which finance option is suitable? It depends on your requirements. Watch the video or read the full transcript that explaining the Chattel Mortgages, Hire Purchase, and Car Lease options.

Transcript

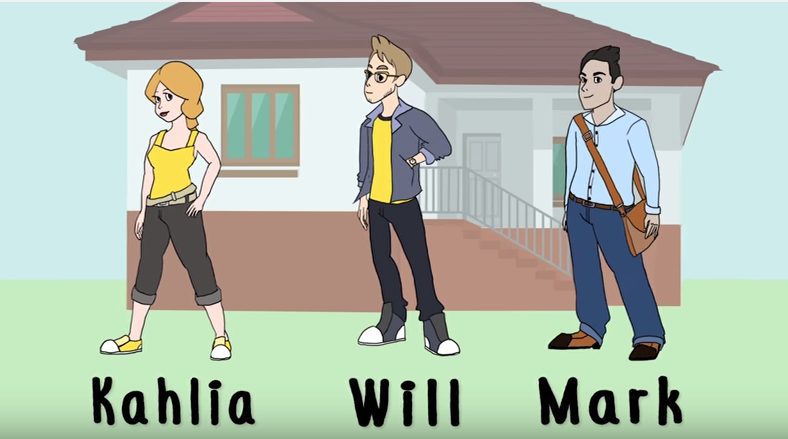

Meet Kahlia, Will and Mark, who all feel the same but have discovered, there’s 3 main products available. Lease, hire purchase and chattel mortgage.

Kahlia has just set up a new super successful fashion business and has decided to take out a lease. Kahlia believes this is the best product for her. She doesn’t need a deposit. Which is convenient as all of her equity is tied up with the new business. The repayments are tax deductible in full meaning her business can minimise it’s tax.

However, the only slight bummer is that at the end of the lease period, although you can usually keep it, the car may go back to the financier but like most business owners, Kahlia can just lease a new car, and in her business you gotta keep with the latest and greatest in style anyway.

That’s not a problem for the biggest Tech-head on the block. Will who has selected hire purchase as his way to go. Working as a contractor for various technology firms, Will works for himself. As such, this typical facts and stats kinda guy has worked out while his ‘hire purchase’ may look much the same as Kahlia’s lease, they are different. Hire Purchase includes the certainty that at the end of the hire period the vehicle is his to keep, which gives him some certainty in his current position.

Mark, the numbers man, likes to know exactly what column to put anything new he’s bought into. The ‘chattel mortgage’ puts his dream car, for a humble accountant, right into the asset column! As he owns it straight away.

Chattel Mortgage

The chattel mortgage is a loan agreement. It can be 100% funded or equity like a deposit or trade can be contributed. Tax deduction is usually the interest on the facility and depreciation and if you’re a business and registered for GST, the GST on the purchase price can usually be claimed.

The chattel mortgage is the most popular product at the moment. Thanks to it’s flexibility and the ways in which it caters to most wants and needs.

To get more info on what product you think may best serve you. To get advice relevant to your situation, contact to Finance Ezi today!

Call us on 1300 003 003 or apply online to get things moving.